For tourists visiting the Philippines, understanding currency conversion is essential to avoid scams and maximize your budget. Dos include researching exchange rates, using reputable establishments, and tracking receipts. Don’ts include exchanging money in unlicensed establishments and converting all your money at once.

We’ll provide guidelines for exchanging currency, finding a reputable exchanger, understanding fluctuating exchange rates, as well as tips for keeping your transactions safe and secure. So whether you’re an experienced traveler or a first timer to the Philippines, this blog has all the information you need to maximize your savings when converting your currency.

Currency Conversion in the Philippines for Tourists

Visiting the Philippines can be an incredibly rewarding travel experience for any tourist, so being informed about the currency conversion rates is essential. The official currency of the Philippines is the Philippine Peso (PHP). It can be helpful to have physical Philippine Pesos before arrival as ATMs may be hard to find in some rural areas.

USD is widely accepted in hotels and larger attractions, but the exchange rate usually has a higher markup than at a traditional bank. When shopping and dining, it’s best to always use PHP to get the most value for money. Tourists should also be sure to check local customs laws before traveling with large amounts of cash.

Dos

The Dos and Don’t of Currency Conversion in the Philippines can be tricky for tourists to remember, but by arming yourself with the right knowledge, you will have safe and informed experience while traveling in this country.

Research on the current exchange rate

Touring any country can be a very exciting and rewarding experience, but it’s important to make sure you’re taking the necessary precautions to ensure a successful holiday. Researching the current exchange rate in the Philippines is an essential step for any traveler interested in currency conversion while vacationing in the tropical nation.

Knowing how much your own money will buy helps keep you on budget, as well as avoiding potential risks involved with currency conversion. Understanding all the dos of changing currencies will enable tourists to maximize their spending without being overcharged or unknowingly charged fees.

Check for fees and charges

With the increasing globalization of trade and travel, currency conversion can become a significant part of your vacation planning process. It pays to thoroughly check for any fees or charges associated with currency exchanges

Be sure to read up on the applicable regulations in the Philippines, ask about any special offers or discounts that are available, compare exchange rates across different vendors, and look for information about any transaction costs or banking fees before you make a final decision. To get the most out of your vacation funds and ensure that you stick to your budgeting goals, making sure you know about potential fees and charges is one of the do’s of successful currency conversion in the Philippines.

Bring cash in major currencies

For tourists to the Philippines, having a method of payment that is easily accepted and intelligently managed is essential. Bring cash in major currencies such as US Dollars, Euros, British Pounds, and Australian Dollars will provide the best opportunity to stay on budget while enjoying your stay.

These are widely accepted across major outlets and are also convertible should you decide to take advantage of local merchants or currency exchanges. Carrying these currencies can be effortlessly done since all of them can be brought in paper bills which are much lighter than their respective coins. Cash transactions also avoid any fees associated with credit or debit transactions charged by your home country’s banking institution.

Use reputable money changers or banks

Traveling to the Philippines and not knowing the best way to convert their money can be daunting. One tip for foreign tourists is to use reputable money changers or banks for currency conversion. These trusted entities offer more favorable exchange rates and provide piece of mind when carrying out the transaction.

It’s important for travelers to ensure they bring appropriate identification such as a passport or driver’s license before entering the premises, which is often required for larger transactions. In addition, it’s beneficial for tourists to check foreign currency values in advance to compare against advertised rates in order to get an understanding of realistic pricing expectations. Utilizing reputable money changers and banks can be an efficient way to convert money while visiting the Philippines, making it easier and less stressful while allowing travelers to enjoy their vacation.

Keep track of receipts and count money carefully

When visiting the Philippines as a foreign tourist, keep track of all receipts and count your money carefully to make sure you are getting the most out of your currency conversion. Exchange rates fluctuate often, so it is wise to shop around for the best rate before exchanging money and remember to always use reputable exchange shops or banks.

Doing research beforehand on available exchange options could save a significant amount in terms of conversion fees. Checking local websites or asking locals in the area can help tourists avoid being taken advantage of with unrealistic exchange rates. Ultimately, monitoring your money closely can go a long way when converting currency in The Philippines.

Notify your bank about your travel plans

When traveling to the Philippines, it is an important step to ensure that your bank is kept up-to-date on your activity. Notifying your bank of any upcoming travel plans can save you a lot of hassle and money by preventing undue fees for foreign transactions. By providing advance notice about your trip and its estimated length, you can inform your bank of any potential currency conversion needs.

This will help decrease banking fees associated with exchanging currency converting from one national currency to another and increase the security of those seeking to avoid scams or overpayment when dealing with local vendors and exchanges. Knowing the dos when it comes to currency conversion can make a world of difference in how much money you save during your travels as well as provide incredible peace of mind for such a large life event as international travel.

Don’ts

When traveling to the Philippines, tourists must be aware of the dos and don’ts of currency conversion to avoid losing money or being scammed. While there are numerous currency exchange establishments across the country, not all of them are trustworthy or offer favorable rates.

Exchange money in unlicensed or unregistered establishments

When visiting the Philippines, tourists must be aware of any money conversion schemes they may encounter while in the country. It is important to remember that exchanging money anywhere other than an approved exchange facility can be risky and illegal. Unlicensed or unregistered establishments do not offer the same protection that legitimate currency exchange centers can provide, nor can their rates guarantee competitive deals.

Moreover, such establishments often have high service charges or hidden fees that may make their transaction cost more for travelers than when using financial services registered with relevant Philippine government agencies such as Bangko Sentral ng Pilipinas (BSP). Using any unlicensed or unregistered institutions for exchanging money is not recommended.

Accept damaged or counterfeit bills

Tourists visiting the Philippines should be aware that it can be tempting to accept damaged or counterfeit bills while converting currency, however, doing so is incredibly risky. The Philippine government has strict laws regarding counterfeit money and anyone caught using or carrying fake bills may face steep fines and/or jail time.

Even if you don’t get caught committing this crime, fake bills may not be accepted in various transactions within the country meaning you could find yourself without money and without a valid form of payment. Since this topic can be confusing for tourists, it’s important to avoid any temptation and only exchange currency with valid sources to ensure a safe and successful trip while abroad.

Exchange money at airports or hotels with unfavorable rates

When visiting the Philippines, it is important to understand the rules and regulations regarding currency conversion. It is highly advised not to exchange money at airports or hotels as they often have unfavorable rate. These services are known to be expensive in comparison to professional currency exchanges and even banks.

Tourists should research competitive currency exchange rates before they travel so they can save valuable vacation time, energy and money. The best option for those looking to convert currencies are various exchange banks, mobile money transfer services and even currency kiosks that offer competitive rates.

Convert all your money at once

As a tourist to the Philippines, it is important to understand the currency conversion process in order to optimize your travel budget. One of the most common mistakes travelers have made when converting their money is to convert it all at once. This can be an inconvenience because different purchase amounts may require different currencies and exchange rates, meaning tourists might unknowingly lose value on conversion.

It is possible that even after converting all funds at once, there may be unexpected expenses along the way for which guests may not have the correct currency available. To maximize savings during currency conversions when traveling to the Philippines, tourists should look into alternatives such as exchanging multiple small amounts or using cards rather than exchanging all funds immediately.

Exchange money in a rush or when distracted

Planning a trip to the Philippines can be both exciting and nerve-wracking, especially thinking about the intricacies of currency conversion. And while there are plenty of tips and tricks to save money when exchanging money in the Philippines, some practices should be avoided altogether.

Exchanging money in a rush or when distracted is often an oversight that tourists are guilty of, yet can severely hurt their wallet in the long run. By simply being mindful and taking your time during the process of currency conversion, travelers will be much better equipped to find a favorable exchange rate and save money for their vacation.

Leave money exchange to the last minute

With the tourism industry booming and alluring travelers from around the world, the Philippines has emerged as one of the most popular tourist destinations. But when it comes to currency exchange while in country, tourists should be wary of leaving it till their last minute.

The fluctuation in currency values, an expensive exchange rate and a lack of resources can quickly result into a chaotic and costly situation if done at the last moment. To attract getting best pricing, tourists should make sure that they do not leave currency exchange to the last minute on their Philippine tour.

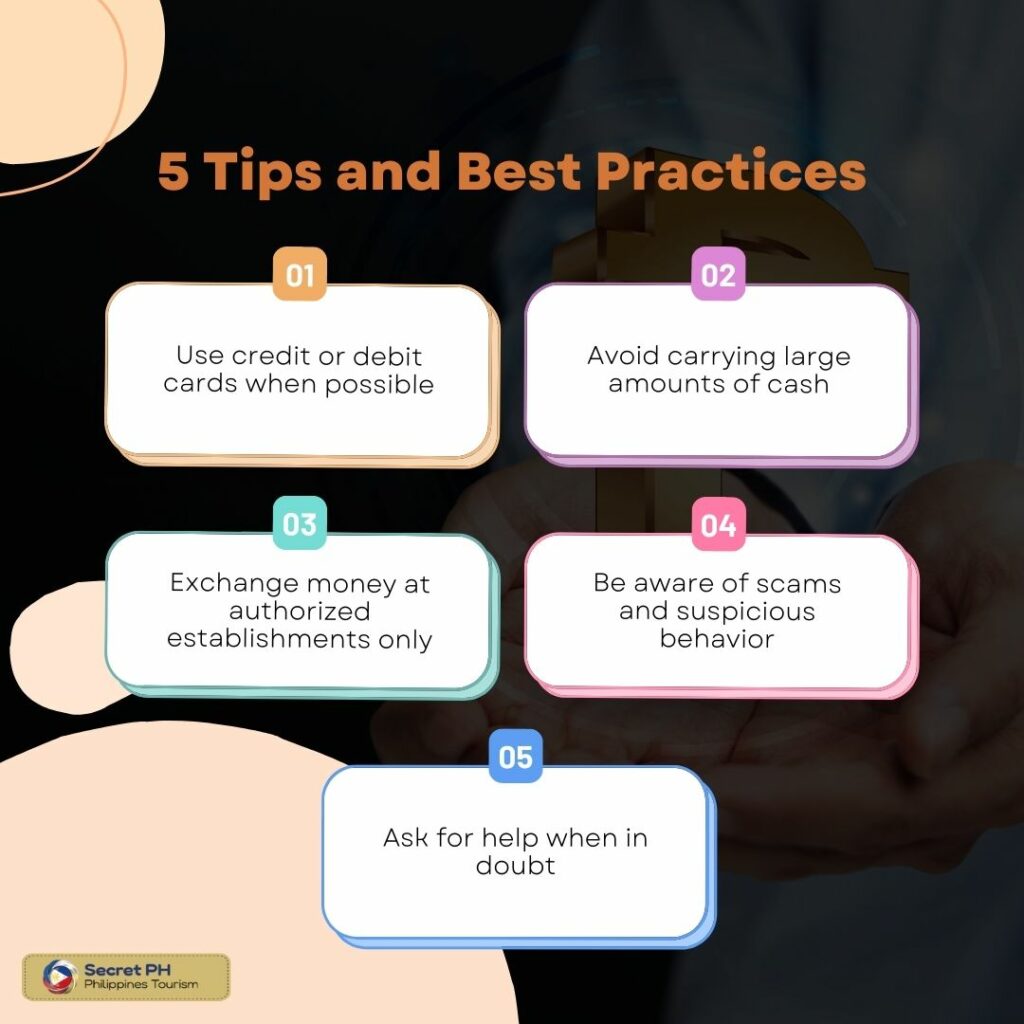

Five Tips and Best Practices

Currency conversion in the Philippines can be a daunting task for tourists, especially if they are not familiar with the process or the local currency. However, by following a few tips and best practices, tourists can make the most out of their money while avoiding scams or unfavorable rates.

Use credit or debit cards when possible

Whenever possible, it is recommended to use credit or debit cards for any transactions made in the Philippines. Tips and best practices to help tourists get the most out of their money include searching for terminals that accept foreign cards and enquiring about any service fees before proceeding with the transaction.

Not only are these methods more convenient, they also provide travelers a safe option when it comes to currency exchange in unfamiliar territory. Tourists should learn which currencies their card issuers accept and consider carrying multiple debit/credit cards from different companies so all payments would go through without a hitch.

Avoid carrying large amounts of cash

When travelling in the Philippines, it is best to avoid carrying large amounts of cash. Tourists should only take as much money as needed for their immediate needs or for expected expenses. It is also important to make sure the cash does not stand out among one’s possessions as doing so could make them a target for theft or pick pocketers.

To protect themselves further, tourists should be familiar with the currency exchange laws and regulations regarding their own country and those of the Philippines before beginning a journey. By following these tips, tourists can have peace of mind while they explore new places and cultures around the Philippines.

Exchange money at authorized establishments only

Converting money while travelling in the Philippines is an important part of ensuring a stress-free vacation. It is recommended to only exchange currencies at authorized establishments, such as banks and remittance centers. This way, tourists can be assured to receive the most accurate rate and avoid sticky situations as a result of being underpaid.

Visitors have access to additional services that are not available with unregistered merchants, including real-time account transfers and payment acknowledgments. In addition to this security measure, tourists should keep track of the exchange rate daily or weekly for further assurance when converting their foreign currencies in the country.

Be aware of scams and suspicious behavior

Being a foreign traveler in the Philippines, it is essential to always be aware of scams and suspicious behavior that may occur during currency conversion transactions. It is important to understand the basics and do your research before actually engaging in currency conversion activities while visiting the country.

Simple steps can be taken to ensure that you are managing your finances safely; pay attention to rate-unrealistically margins between buying and selling rates, make sure there’s government accreditation when doing an exchange, keep track of the amount of cash you have on hand, avoid exchanging currency on the streets and if possible ask for a receipt for every transaction.

Ask for help when in doubt

As a tourist in the Philippines, it is important that you are aware of the current exchange rates before and during your vacation. When in doubt, be sure to always ask for help from an experienced individual or establishment to provide reliable currency conversion advice.

This way, you can be sure that you are getting the most accurate exchange rate as possible, and that your finances are protected. Do not consider attempting to guess or use informal methods of conversion as this could cost you a lot more money in the long run. Asking for help is always beneficial when travelling abroad.

In Conclusion

The Dos and Don’ts of Currency Conversion in the Philippines for Tourists can be essential for any traveler who wants to make sure their money is managed wisely and protect themselves from fraud and price gouging. Knowing when and where it is best use cash or exchange dollars is crucial to ensure a positive financial experience during your travels in the Philippines.

Taking stock of the current market rates ahead of time is always recommended to ensure travelers are getting the best currency deals possible. All in all, arming yourself with knowledge about currency conversion will help you make the most out of your trip to the Philippines but still allow you stay within your budget.