If you’re looking to buy dollars in the Philippines, it’s important to follow the right steps to ensure you get a fair exchange rate and a secure transaction. In this step-by-step guide, we’ll walk you through the process, from determining how much to buy to choosing a reputable provider and safely storing your purchased dollars.

To provide assistance in this matter, this blog post covers a step-by-step guide on how to buy US Dollars (USD) in the Philippines. We will go over details such as popular methods of buying currency, exchange rate options, and bank requirements. So read on for more advice and guidance on how to buy USD in the Philippines.

Why Someone Might Want to Buy Dollars in the Philippines

The Philippine peso is facing turmoil due to local political and economic uncertainty, making it a risky prospect for potential investors. Buying dollars can be a wise option for those who are looking to protect their wealth. The US dollar remains one of the world’s top currencies, offering reliable growth potential in comparison with the Philippines’ local currency.

Ensuring that your funds are held in a stable currency such as the US dollar can help you get more out of your investments by preserving their value over time. Buying dollars in the Philippines can be an attractive proposition even during times of economic distress.

Step 1: Determine the amount of dollars you need to buy

Knowing exactly how much you should purchase can ensure that you have enough cash on hand for your needs. Determining the amount of dollars you need is the first step in this process, so make sure you plan it carefully before starting the conversion process.

Considerations for how much to buy

One of the most important considerations when buying something is determining how much money you need to allocate. It’s essential to know exactly how much you can spend and what your desired outcome is. Start by getting a better understanding of your budget, expenses, and cash flow.

By knowing those parameters, you will be able to calculate the amount of dollars you need in order to purchase the item(s). A good guideline to follow when adjusting your budget is looking at recent transactions and seeing where savings can be made.

Understanding the current exchange rate

Knowing the current exchange rate is a critical part of understanding the cost of international transactions. The purchase price in U.S. dollars should be balanced with both the dollar’s value relative to other currencies. Be informed that additional fees such as fluctuations, commissions, or exchange rate margin fees charged by networks.

Other currency exchanges may make up part of your total cost. Understanding these costs ahead of time can make sure you are getting the best possible price on any international transactions.

Step 2: Choose a reputable currency exchange provider

Choosing a reputable currency exchange provider is an important step in ensuring that your money is exchanged quickly, and safely. You should be wary of services that offer rates that seem too good to be true. They may end up costing you more in the long run. Before deciding on a specific provider, it helps to research by asking around and reading reviews.

Checking their credentials can also be beneficial. Seeing if they are registered with regulatory bodies adds an extra layer of security. By using a trusted provider, you can rest assured knowing that your money is being looked after by professionals.

Researching available providers

When researching available providers, careful consideration should be taken into account to ensure the exchange rate is a good fit. It’s important to ask around for any recommendations, read online reviews and research fees.

Although accreditation and security is essential, it is also important to focus on due diligence. Researching available providers takes time but can lead to significant savings when investing. As such it’s recommended to conduct thorough research before selecting a provider that best suits your needs.

Checking for legitimacy and security

When choosing a currency exchange provider, make sure to do your research first. To gauge the trustworthiness of a provider, look for impartial customer reviews and feedback. Check if they have any industry accreditations which may prove their legitimacy and look into any associations they may have with professional.

Account security should be taken into consideration. Pick a provider that takes measures to provide adequate protection around user data and details. Make sure customers can trust them with their money transfers. By taking the necessary precautions when choosing an exchange provider, you will find comfort in knowing your transactions are being handled.

Step 3: Prepare your identification and documentation

When buying dollars in the Philippines preparing your identification and documentation is important. You will need to provide documents such as proof of identity and income. Together with a government-issued photo ID, to prove you are eligible to purchase foreign currency from either a bank or private money exchange. Having these documents on hand before making an exchange will expedite the process.

Requirements for purchasing foreign currency

Once you have done your research and obtained a quote from a reputable provider, the next step in purchasing foreign currency is to prepare your identification and documentation. This includes valid photo identification such as a passport or driver’s license. It includes your photograph, and signature. The name indicated on the documents must match the name of the person who will be making the currency purchase.

You should also have bank account information that can be used to verify your identity. You need documents that attest your residency or legal citizenship. Don’t forget to bring extras such as utility bill copies or other forms of official indicator mail. With this important paperwork in hand you are now ready to begin the process of receiving and transferring funds.

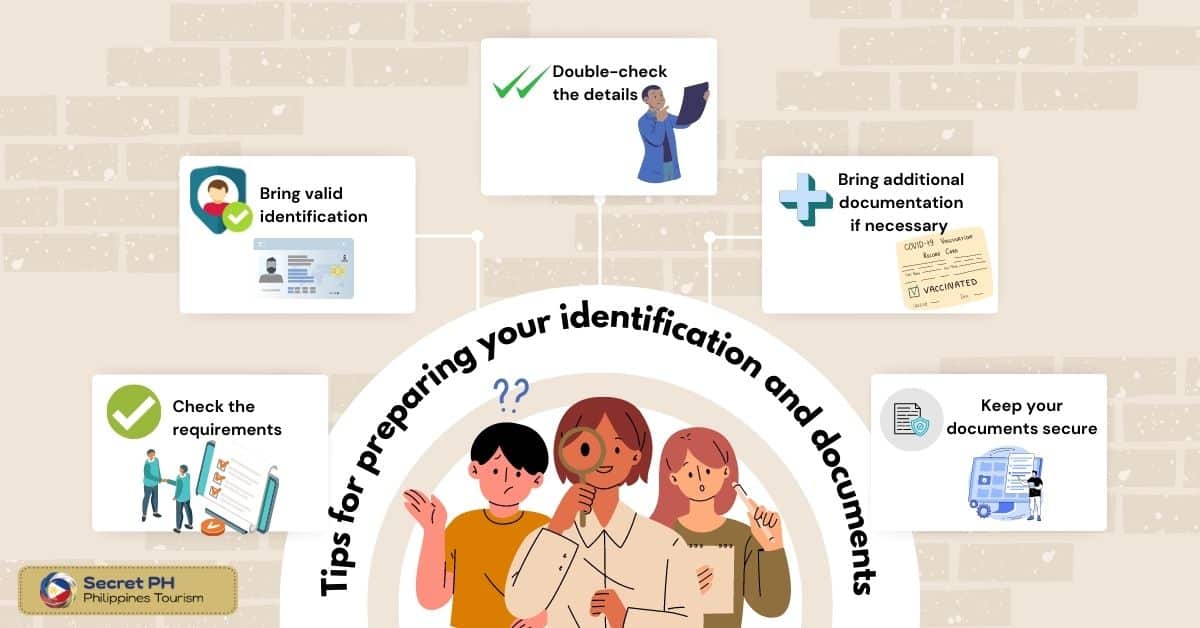

Tips for preparing your identification and documents

If you are applying for a bank loan or credit card, you may need to include a valid photo identification. Ensure that the identification is up-to-date and in good condition so that the providing institution can process. Taking these proper tips early on will help prevent delays in your application assessment.

- Check the requirements – Before going to the currency exchange provider, check what identification and documentation are required for purchasing foreign currency. This will help you prepare the necessary documents in advance and avoid delays or issues during the transaction.

- Bring valid identification – Make sure to bring valid identification, such as a passport or government-issued ID with your photo and signature. It’s important that the identification is current and not expired.

- Double-check the details – Check that the name and other details on your identification match the information you’ll be providing for the transaction. This includes your name, date of birth, and other personal details.

- Bring additional documentation if necessary – Depending on the amount of dollars you’re buying or the currency exchange provider’s policies, you may need to bring additional documentation, such as proof of income or source of funds. Check what’s required in advance and bring the necessary documents.

- Keep your documents secure – Keep your identification and documents secure and within reach at all times. Avoid leaving them unattended or exposing them to potential theft or loss. Consider carrying them in a secure travel document organizer or wallet.

Step 4: Complete the transaction

After an individual has contacted a reliable broker and compared different rates for the best possible deal. The next step in buying dollars in the Philippines is to complete the transaction. This can often be done online or over the phone, with payment methods varying from direct bank deposits.

Professional customer service can be expected when dealing with legitimate brokers. Customers should never hesitate to ask questions or clarify any doubts they may have about the process. Once payment has been confirmed and all relevant details have been checked, customers will receive their dollars in the agreed fashion.

Understanding the transaction process

The final step in the transaction process is completing the transaction. This is when the customer finally pays for whatever it is they are purchasing and receives. The customer typically has to decide between several payment methods such as cash, credit card, gift card, or check.

Each payment method comes with different stipulations from the provider. All parties should be familiar with what’s available and what applies to them. Once the transaction has been completed by all parties involved, this will mark the end of the process.

Tips for getting the best exchange rate

After researching your exchange rate options and completing comparison shopping, the next step is to complete the transaction. Taking these additional tips, you can ensure that you receive the best exchange rate.

- Research the current exchange rate – Before buying dollars, research the current exchange rate to get an idea of the fair value. This will help you negotiate for a better rate if necessary.

- Shop around – Don’t settle for the first currency exchange provider you come across. Shop around and compare rates from different providers to find the best deal.

- Avoid high-commission providers – Some currency exchange providers may charge high commissions or fees, which can significantly reduce the amount of dollars you’ll receive. Look for providers with reasonable rates and minimal fees.

- Negotiate – Don’t be afraid to negotiate for a better rate. Some providers may be willing to offer a better deal if you’re buying a large amount of dollars or if you’re a regular customer.

- Consider timing – The exchange rate can fluctuate throughout the day or week, so consider timing your purchase to get the best rate. Monitor the rate over a period of time and buy when the rate is favorable.

Step 5: Securely store your purchased dollars

To ensure that you do not become a victim of theft or fraud, it is vital to properly store your purchased dollars. Storing the physical notes is an important part of the process. Ensure that they are kept in a safe location, away from prying eyes. Electronic and/or virtual currencies such as Bitcoin should also be secured by creating strong passwords.

Tips for storing foreign currency safely

Once you have purchased your foreign currency, the next step is to secure it. Store it in a safe and reliable place such as a fireproof safe with an electronic lock. If available, you may be able to opt into specialized foreign currency storage. With these tips, you can be assured that your purchase of foreign currency is securely stored and ready for your next international adventure.

- Use a secure location: Store your foreign currency in a secure location, such as a safe or a safety deposit box at a bank. This will reduce the risk of theft or loss.

- Avoid keeping too much cash on hand: Keep only the amount of foreign currency you need and avoid carrying large amounts of cash with you. This will reduce the risk of loss or theft.

- Keep your currency organized: Keep your foreign currency organized and separated by denomination. This will make it easier to access and count your cash, and it will reduce the risk of confusion or mistakes.

- Use security features: If your foreign currency has security features, such as watermarks or holograms, use them to verify the authenticity of your cash. This will reduce the risk of accepting counterfeit currency.

- Keep your currency discreet: Avoid drawing attention to your foreign currency by keeping it discreet. Avoid showing it off in public or discussing it with strangers. This will reduce the risk of theft or scams.

Considerations for spending or converting your dollars back to Philippine pesos

When buying dollars in the Philippines, it’s important to consider what you’ll do with them once you’ve completed your trip or transaction. Here are some considerations for spending or converting your dollars back to Philippine pesos:

- Exchange rates – The exchange rate can fluctuate over time, so consider monitoring the rate to determine when it’s favorable to convert your dollars back to pesos. This will help you maximize your exchange rate and get the best value for your money.

- Fees and commissions – When converting your dollars back to pesos, be aware of any fees or commissions that may be charged by currency exchange providers or banks. Look for providers with reasonable rates and minimal fees to ensure you get the best value for your money.

- Timing – Consider timing your currency conversion to get the best exchange rate. Monitor the exchange rate over a period of time and convert your currency when the rate is favorable.

- Spending options – If you plan to spend your dollars in the Philippines, consider using a credit or debit card that offers competitive exchange rates and minimal fees. This can help you avoid the hassle of currency conversion and ensure you get the best value for your money.

In Conclusion

The process of buying dollars in the Philippines can seem daunting, however if you follow a few simple steps it can be done quickly and easily. Understanding how much money you need and which provider to use will ensure the process is smooth. Exchanging Pesos for US Dollars at remittance centers, banks, or money changers is a great way to start your journey.

Because each provider offers different rates and fees it’s important that you do some research ahead of time to find the best option for you. By following this Step-by-Step Guide: How to Buy US Dollars in the Philippines you should now have an excellent understanding of what’s required to complete this task successfully.