Visiting the Philippines and looking to exchange your currency? Before making the transaction, ensure you know all the tips and tricks for exchanging money in this tropical adventure land.

It’s important to get the most out of your money to enjoy a stress-free and budget-friendly stay. Get acquainted with the exchange rate and know when it’s beneficial to use ATMs instead of currency exchanges.

Make the most of your budget by knowing where to exchange currency in the Philippines. With these pointers in mind, you’ll have all the essential knowledge to ensure your hard-earned cash is spent wisely during your trip to the Philippines.

Overview of Currency Exchange in the Philippines

Exchange money in the Philippines confidently by knowing which currency is used and how to access it. The Philippine Peso is the primary exchange form, though US Dollars are also accepted.

Different establishments, like money changers and banks, offer exchange services. Remember to check current exchange rates before exchanging your funds. Local merchants often display their prices in currencies such as Euros or American Dollars instead of the local currency– so be sure to confirm what currency they use before making a purchase.

Additionally, research credit card and ATM fees to determine which type of payment instrument will provide you with the most secure and cost-effective transaction experience.

Ultimately, understanding basic information about exchanging currency in the Philippines can save you time, money, and stress abroad!

Types of Currencies Used in the Philippines

When visiting the Philippines, it is helpful to know a bit about the types of currencies. Officially speaking, the Philippine Peso (PHP) is the only legal currency accepted throughout the entire country.

However, U.S Dollars (USD) are also commonly accepted for purchases in tourist areas and at certain shops and restaurants.

Additionally, most major banks offer convenient foreign exchange services for any major currency by order or local cash withdrawal.

Check with your financial institution what fees may apply before you travel and understand the current exchange rate from your home currency to pesos or U.S. dollars.

Where to Exchange Currency in the Philippines

Travelers to the Philippines have numerous options when deciding where to exchange currency. Bank branches throughout the country provide foreign exchange and money-wiring services, making them a great option for most travelers.

In addition, large malls that operate banks inside typically provide foreign exchange services at reasonable rates.

Furthermore, some hotels in major cities also offer currency exchange services, although they often have higher rates than banks. Finding a money changer in busy areas is also an option for those who prefer to forego banking services, as these establishments usually provide competitive rates.

Ultimately, travelers to the Philippines have multiple convenient methods for exchanging their currency and should easily be able to find an option that suits their needs.

What Documents Do You Need to Exchange Currency in the Philippines

Knowing the documents, you need to exchange currency in the Philippines. It is compulsory for anyone exchanging foreign currency in the Philippines to have a valid passport and Bank Certificate of Nomination.

The Bank Certificate must be issued on the day of your exchange, contain wording specific to currency exchange transactions, and come from a local bank and branch within the Philippines.

Additionally, if exchanging more than USD $10,000 or its equivalent in another foreign currency, you’ll need to fill out a Report of Foreign Exchange Transactions (BSP Form FX-6).

This document proves that the amount being exchanged was acquired through legal and legitimate sources.

Lastly, exchanges require additional documentation or disclosure for amounts greater than USD $30,000 per individual per calendar year and should go through BIR or SEC-approved financial institutions. Making sure all documents are gathered before your currency exchange process ensures peace of mind throughout your transaction.

Tips for Exchanging Money Safely and Securely

Exchanging currency in the Philippines is easy, but there are a few important points to remember to do it safely and securely.

- Research: Do your research and compare exchange rates and fees from multiple currency exchange providers to ensure you’re getting the best deal.

- Use a reputable provider: Use a reputable and well-established currency exchange provider to avoid scams and fraud.

- Be aware of scams: Be cautious of deals that seem too good to be true, and be aware of common scams, such as counterfeit currency or phishing emails.

- Keep your personal information safe: Be careful when providing personal information, such as your name, address, and credit card number, and make sure the currency exchange provider has adequate security measures to protect your information.

- Use secure payment methods: Use secure payment methods, such as credit cards or secure online transfers, to avoid theft or fraud.

- Keep receipts and records: Keep receipts and records of all your currency exchange transactions to help you keep track of your finances and resolve any disputes that may arise.

By following these tips, your exchange process should be quick and easy!

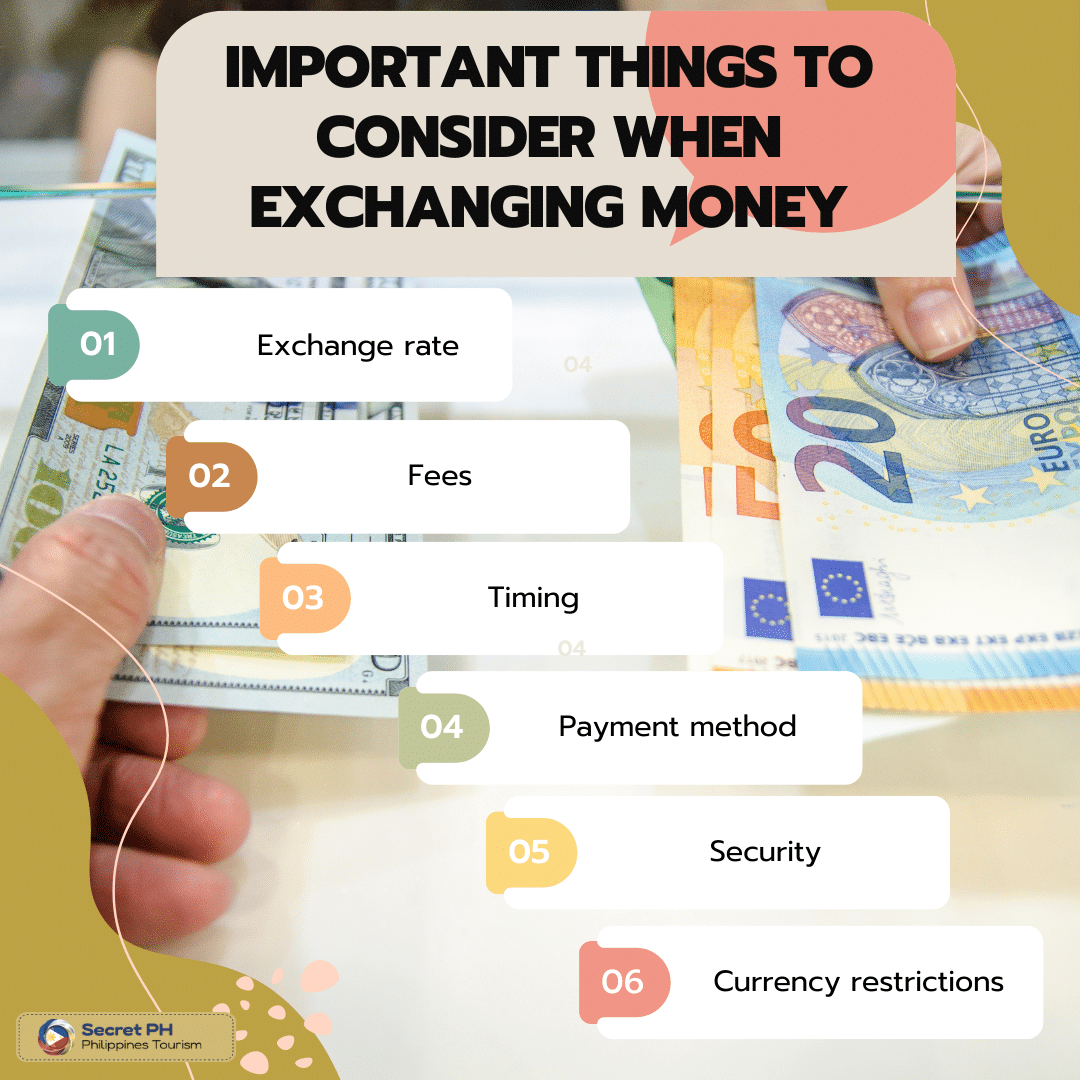

Important Things to Consider When Exchanging Money

When exchanging currency in the Philippines, you must consider several important factors.

- Exchange rate: The exchange rate is the rate at which one currency can be exchanged for another. It’s important to compare rates from different sources to get the best deal.

- Fees: Different currency exchange providers will charge different fees, so it’s important to compare them and choose the provider with the lowest fees.

- Timing: The timing of when you exchange your money can also affect the exchange rate, so it’s important to time your exchange correctly to get the best deal.

- Payment method: Different payment methods, such as cash, credit/debit card, or bank transfer, can affect the exchange rate and fees, so it’s important to choose the payment method that works best for you.

- Security: It’s important to choose a reputable and secure currency exchange provider to avoid fraud or theft.

- Currency restrictions: Some countries have restrictions on the amount of currency that can be brought in or taken out of the country, so it’s important to check these restrictions before exchanging money.

These guidelines will help make your money exchange experience more seamless and stress-free.

Final Thoughts on Exchanging Currency in the Philippines

Exchanging currency in the Philippines is a simple and straightforward process as long as you know what to expect.

With this article’s helpful tips and tricks, you can feel confident knowing that your money exchange experience will be smooth sailing! Research current rates and fees from multiple sources before making any transactions.

Know which documents are needed for exchanging larger amounts of foreign currencies. And always use secure payment methods when possible to avoid theft or fraud. Armed with these guidelines, you’ll be on your way to having an enjoyable stay in the beautiful country of the Philippines while saving some extra cash!