Currency conversion can be a daunting task, especially when traveling between different countries. Fortunately, there are several steps that you can take to save money when converting currencies in the Philippines.

Consider using local ATMs instead of international ones, transferring money internationally through online platforms, negotiating exchange rates at hotels and local changers, and taking advantage of promotions and discounts offered by banks and exchange providers.

Armed with this information, anyone visiting or living in the Philippines can find peace of mind when exchanging their currency.

Choosing the right exchange provider

When traveling or conducting international transactions, exchanging currency can often be a necessary step. However, the cost of converting currency can quickly add up, especially if you choose the wrong exchange provider. Choosing the right exchange provider is crucial in saving money on a currency conversion, as different providers offer different exchange rates and fees.

Choosing the right exchange provider is crucial to saving money on currency conversion in the Philippines. Here are some key factors to consider:

- Exchange rates: Compare the exchange rates offered by different providers to ensure you get the best deal. Keep in mind that exchange rates can fluctuate, so it’s a good idea to monitor them regularly.

- Fees: Some exchange providers charge fees for converting currency, so be sure to compare the total cost of exchanging money, including both the exchange rate and any fees.

- Location: Consider the location of the exchange provider. It may be more convenient to use a provider located near your home or office, but you may be able to find a better exchange rate if you are willing to travel a little further.

- Reputation: Read reviews and check the reputation of different exchange providers before making your decision. Make sure the provider you choose is reliable and has a good track record.

- Customer service: Good customer service is important when exchanging currency, especially if you have questions or concerns. Choose a provider that offers responsive and knowledgeable customer support.

By taking these factors into consideration, you can choose the right exchange provider and save money on currency conversion in the Philippines.

Using local ATMs instead of international ones

Using local ATMs is often the most economical way to withdraw cash while traveling abroad. Although you may be charged a fee for withdrawing money from an ATM in another country, these fees are typically lower than those associated with international ATMs.

Additionally, by using a local ATM that accepts your card, you can avoid extra fees charged by certain banks for using their international ATMs.

Knowing which banks are accepted by the local ATM can help you avoid additional surcharges when traveling abroad. For example, if your bank charges a fee for using an international ATM, it is best to use another bank’s ATM that does not charge this fee.

Be sure to check with your own bank to see which foreign ATMs are part of their network and which ones may charge additional fees.

When using a local ATM abroad, make sure you know the exact address of the ATM machine and take extra precautions to keep your card number secure. Be aware of any possible scams or frauds that could occur when using an unfamiliar ATM in another country.

Overall, using local ATMs can be a convenient and cost-effective way to access cash while traveling abroad. By researching the options available to you before you leave home, you can save money on fees and ensure that your withdrawals are safe and secure.

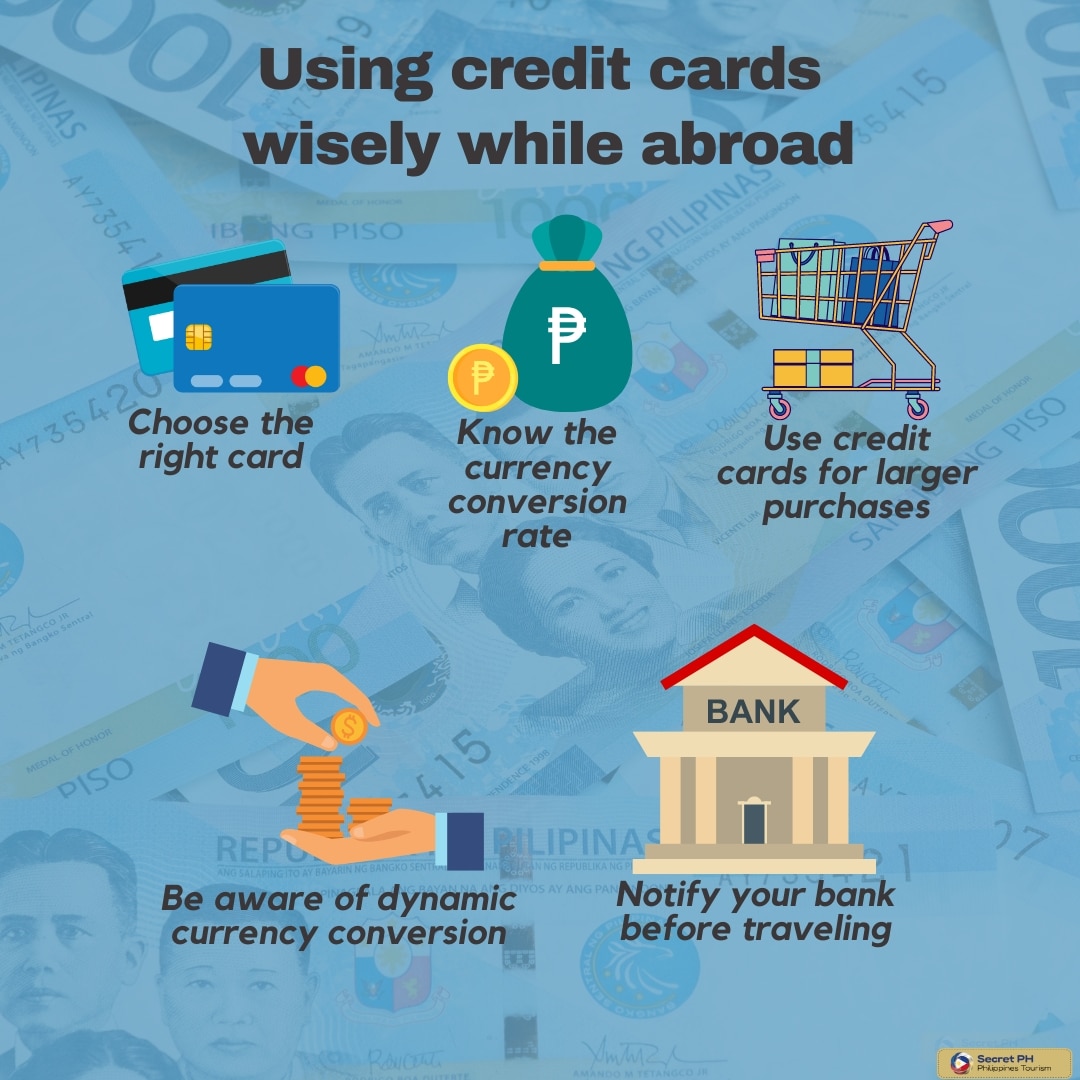

Using credit cards wisely while abroad

Using credit cards wisely while abroad can help you save money on currency conversion in the Philippines.

By using a credit card that doesn’t charge foreign transaction fees and by being mindful of exchange rates and fees, you can reduce the cost of using your card while abroad.

- Choose the right card: Different credit cards have different exchange rates and fees, so choose a card that offers a competitive exchange rate and low or no foreign transaction fees.

- Know the currency conversion rate: Check the currency conversion rate for your credit card and compare it with the current exchange rate to see if you’re getting a good deal.

- Use credit cards for larger purchases: Credit cards usually offer a better exchange rate than cash or debit cards, so use them for larger purchases, such as hotel stays or rental cars.

- Be aware of dynamic currency conversion: Some merchants may offer to convert your purchase amount into your home currency at the point of sale. Avoid this option as it often comes with a higher exchange rate.

- Notify your bank before traveling: Let your bank know that you will be traveling and using your credit card abroad, as some banks may block transactions if they suspect fraud.

Transferring money internationally through online platforms

Transferring money internationally through online platforms is becoming an increasingly popular option for those looking to save money on currency conversion. With the rise of digital banking and payment services, it is now easier than ever to transfer funds from one country to another with minimal fees.

When transferring money abroad, many platforms offer competitive exchange rates that are close to the mid-market rate. This can allow you to get more bang for your buck when sending money internationally.

Additionally, almost all online platforms are offering free transfers if you send over a certain amount of money – this helps to lower the cost of currency conversion even further.

When choosing an online platform for international transfers, it is important to compare different options to ensure you are getting the best deal. Different platforms may have different fees and exchange rates, so it is important to shop around and find one that works for your needs.

Look out for any hidden fees such as international transfer fees or minimum balance requirements.

Negotiating currency exchange rates at hotels and local money changers

When traveling to the Philippines, it is important to be aware of how exchanging currency can impact your budget. Negotiating currency exchange rates at hotels and local money changers can help you get the most out of your money when converting from one currency to another.

By understanding how different currencies are exchanged, you can save time and money on currency conversion. This guide will provide tips and tricks on how to negotiate the best exchange rates at hotels and local money changers while in the Philippines.

By knowing which currency pairs are most favorable, understanding how different currencies are exchanged, and being aware of possible fees or scams associated with exchanging money, you can ensure that you get the most out of your money.

Additionally, by doing some research ahead of time and shopping around for the best rates, you can save even more money on currency conversion while in the Philippines.

When negotiating rates with local money changers, it is important to know the mid-market rate of the currency you are exchanging. This will ensure that you get the best rate possible when converting your money.

Ask about any fees or extra charges associated with the currency exchange before agreeing to a rate.

If you plan to exchange money at a hotel, it is important to keep in mind that these locations typically offer lower exchange rates than local money changers. However, many hotels are willing to negotiate the rate if you ask for a better one.

Be sure to check for any additional taxes or fees associated with exchanging your currency at the hotel.

Overall, by negotiating currency exchange rates at hotels and local money changers, you can save time and money on currency conversion while in the Philippines.

By doing some research ahead of time, understanding how different currencies are exchanged, and being aware of any extra fees associated with exchanging your currency, you can ensure that you get the most out of your money.

Taking advantage of promotions and discounts offered by banks and exchange providers

Taking advantage of promotions and discounts offered by banks and exchange providers can help you save money on currency conversion while traveling to the Philippines. Banks and exchange providers often offer promotional rates or discounts when converting large amounts of foreign currency.

Additionally, certain banks may also offer special deals for transferring money abroad. It is important to research different options to ensure you get the best rate possible. When looking for promotions and discounts, it is important to compare different banks or exchange providers to find the one that offers the best deal.

Be sure to read any terms and conditions associated with promotional rates or discounts before agreeing to them. This will help ensure that you understand all costs involved in your currency conversion.

It is important to be aware of any additional fees or taxes associated with exchanging currency in the Philippines. Make sure you research any potential fees before deciding which bank or exchange provider to use. This will help you save money on currency conversion while in the country.

In conclusion

With currency conversion, it is essential to have the latest information about the current exchange rate and be careful when converting so as to not lose out on money.

By being aware of how foreign currency exchanges work and being clever with spending abroad, you can save a lot of money when dealing with currency in the Philippines. Practical tips such as researching which stores exchange currencies or finding ATMs that give good exchange rates will ensure you get the maximum value for your money.

It is also recommended that you withdraw only what you need and keep an eye on the changing currency prices to get the best deal. With these considerations taken into account, you are sure to save a significant amount whenever dealing with foreign currencies while in the Philippines.