Maximizing your travel budget is crucial for an enjoyable and stress-free trip. In the Philippines, currency conversion strategies can help you get the most out of your budget. Understanding exchange rates, finding the best conversion options, and avoiding common mistakes are key to maximizing your budget while traveling in the Philippines.

In this blog, we’ll explore the key elements of currency conversion and provide tips and tricks to help you maximize your travel budget in the Philippines. Whether you’re a seasoned traveler or a first-time visitor, this guide will give you the tools you need to have a cost-effective and memorable trip.

Currency Conversion Strategies for the Philippines

Currency conversion can be tricky business, but with a few strategies and some good advice it can help businesses in the Philippines make the most of their money. One key strategy is to take advantage of exchange rate variations in different countries. Many Filipino businesses have had success by making use of local currency exchanges within their own country as well as other foreign countries where currency conversions are favorable.

Shopping around for the best rates on foreign exchange services is essential for optimizing the profits from your transfers. Many Filipino companies use smart technologies such as automated FX conversion technology that enable a fluid and efficient transfer of funds from one currency to another.

Understanding Currency Exchange Rates

Understanding currency exchange rates is a vital skill for anyone conducting international business transactions. With the globalization of markets, businesses must remain savvy and aware of developments in foreign exchange. Taking the time to understand how currencies are traded and the factors which affect their value is an invaluable asset for any organization involved in global commerce.

Definition of currency exchange rate

Understanding currency exchange rates can give someone a better insight into the global economy and provide an advantage when conducting international transactions. A currency exchange rate is the value of one currency expressed in terms of another, signifying how many units of the second currency it takes to purchase one unit of the first currency.

This affects how people purchase goods and services from foreign countries, and understanding fluctuations in exchange rates can help people make more informed decisions about their money. Having knowledge of current exchange rates can also occur beneficial when travelling or investing abroad, as it provides insight into the true cost of a transaction.

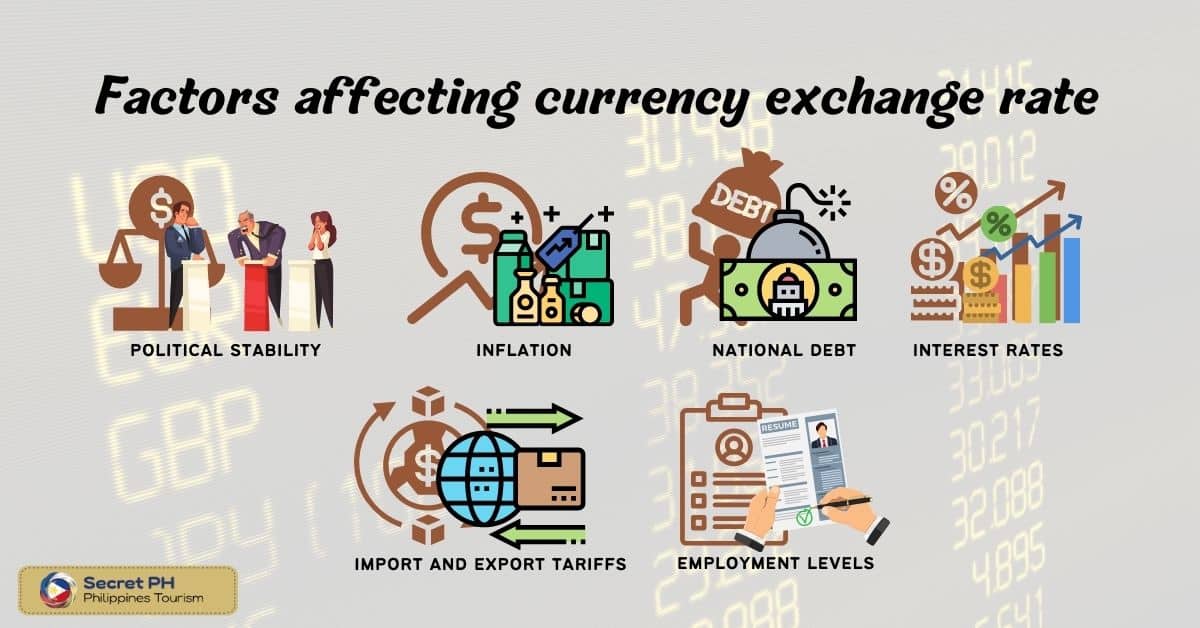

Factors affecting currency exchange rate

Factors that affect currency exchange rates may be macro- and micro-economic in nature. Factors such as political stability, inflation, national debt, interest rates, import and export tariffs, employment levels, and more can have an effect on currency exchange rates.

The monetary policies of banks, central governments and other institutions may influence the value of a currency versus another. It is important to stay abreast of the changing fluctuations in currencies to ensure you are making the most informed decision when exchanging yours.

Importance of staying updated with current exchange rates

Currency exchange rates play an important role in many aspects of international business and finance. Factors such as local economic stability, political events, the strength of a country’s central bank, and inflation all affect currency values.

In both cases, knowledge of how exchange rates work and can fluctuate over time can greatly influence financial results. Thus, it’s important to arm yourself with information on global markets so that informed decisions regarding monetary transactions can be made with confidence.

Finding the Best Currency Exchange Options

Searching for the best currency exchange options can be a daunting endeavor, as there are plenty of factors to take into account in order to get the best rate. In order to make sure you’re getting the highest value for your money, it’s important to understand all of the different types of currency exchange available and their associated fees.

Shopping around for the best rate is one of the most effective strategies for reducing transaction costs and maximizing your returns on international transactions. It’s worth considering how you intend to transfer funds abroad and how much you’d like to send when making this decision, as this will have a significant impact on which provider gives you the best value.

Banks

Banks are popular providers of foreign currency, however they are often one of the most expensive, as they charge higher fees and offer less competitive rates. Alternative options to consider include online money transfer services, cash exchange kiosks, or prepaid cards.

It is important to compare various sources to find the option that best suits your needs. Investing a bit of time into finding the right solution can end up saving you a considerable amount of money in the long run.

| ADVANTAGES | DISADVANTAGES |

| Convenient locations: Banks have branches located throughout the country, making it easy to find a branch near you. | High fees: Banks often charge high fees for currency conversion, which can add up quickly and eat into your travel budget. |

| Safe and secure: Banks are regulated and insured, making them a safe and secure option for currency conversion. | Limited hours: Banks may have limited hours of operation, which can be inconvenient for travelers who need to convert currency outside of regular business hours. |

| Reliable exchange rates: Banks typically offer competitive exchange rates, which can be more favorable than those offered by other exchange options. | Slow service: Banks can be slow and bureaucratic, which can be time-consuming for travelers who need to quickly convert currency. |

Currency exchange centers

Currency exchange is an essential part of international travel, as different countries have different currencies. It can be tricky to figure out the best currency exchange options available for each trip; luckily, there are many resources available to help individuals find the best currency exchange centers.

Currency exchange centers are usually open whenever banks and other financial institutions are open and offer competitive rates along with helpful customer service. Depending on their location, travelers may even be able to use online services or mobile apps for convenient currency exchange options.

| ADVANTAGES | DISADVANTAGES |

| Competitive exchange rates: Currency exchange centers often offer competitive exchange rates, which can be more favorable than those offered by banks. | Hidden fees: Currency exchange centers may charge hidden fees for their services, which can add up and impact your travel budget. |

| Fast and efficient service: Currency exchange centers are often staffed with trained professionals who can quickly and efficiently handle currency conversion. | Limited currency options: Currency exchange centers may only offer a limited number of currency options, which can be a disadvantage for travelers who need to convert a specific currency. |

| Convenient locations: Currency exchange centers are often located in tourist areas and airports, making them a convenient option for travelers. | Potential for scams: There is a risk of scams at currency exchange centers, especially in tourist areas where travelers may be less familiar with local exchange practices. |

Online currency exchange services

Online currency exchange services provide the ability to quickly and easily compare exchange rates between providers, allowing you to find the best rates for sending money overseas. When looking for a reliable option, pay attention to fees and charges as well as exchange rates.

Many options offer free and low-cost transfers, but these may come with higher exchange rates. Different currencies attract different fees and levels of customer service support. Research into online currency exchange services can help identify the most suitable platform that meets your individual needs.

| ADVANTAGES | DISADVANTAGES |

| Competitive exchange rates: Online currency exchange services often offer competitive exchange rates, which can be more favorable than those offered by banks or currency exchange centers. | Security risks: Online transactions can be vulnerable to security risks, such as hacking and fraud. It’s important to use reputable online currency exchange services and protect your personal and financial information. |

| Convenient and fast: Online currency exchange services allow you to convert currency from the comfort of your own home, making them a convenient and fast option for travelers. | Hidden fees: Some online currency exchange services may charge hidden fees for their services, so it’s important to carefully read the terms and conditions before making a conversion. |

| Easy to compare rates: Online currency exchange services allow you to compare exchange rates from multiple providers, helping you find the best deal for your budget. | Limited options for cash withdrawal: While online currency exchange services are convenient for converting currency, they may not be the best option for withdrawing cash while traveling in the Philippines. |

Tips for Maximizing Your Budget Through Currency Conversion

If you want to maximize your budget while making financial transactions across borders, currency conversion is an efficient tool to use. Currency conversion enables you to utilize different exchange rates and money-saving options when converting from one currency to another.

Planning ahead and researching exchange rates

Planning ahead of time is one of the most effective ways to maximize your budget through currency conversion. Whether you are travelling abroad or conducting international business, researching current exchange rates and taking advantage of lower fees and higher interest rates can potentially result in significant financial savings.

Planning ahead should be part of any travel or financial plan to ensure the best possible return on investment when dealing with foreign currencies. Knowing who you can trust for reliable, economical exchanges as well as understanding market trends and speculating when to exchange can also help you maximize your budget through smart currency management.

Bringing the right mix of cash and cards

Bringing too much cash leaves you vulnerable to theft, putting it in danger of becoming irretrievable, while attempting to use your credit card for every purchase may result in expensive transaction fees for each transaction.

To ensure maximum budget flexibility, bring an amount that allows for emergency expenses with a mix of cards and cash so you can benefit from favourable exchange rates when converting currencies or access funds quickly with little cost when needed. Obtaining a full picture of potential banking fees should help plan and avoid extra costs while abroad.

Avoiding high exchange fees

Utilizing currency conversion effectively can help you maximize your budget to get the most out of your money. Avoiding high exchange fees is one of the tips that should be followed in order to make sure you achieve the highest value for your currency.

Shop around for lower rates, as some online services and banks offer better exchange rates than others. Being mindful about when and where you are exchanging your currencies can help save money. Using credit cards abroad can be a great way to take advantage of favorable exchange rates without any hidden fees.

Making conversions at favorable times

Making wise decisions when converting currencies can help maximize your budget through currency conversion. Making conversions at the right time, such as when the exchange rate is in your favor, can result in more spending power.

Researching trends ahead of time and monitoring financial news are two ways to stay informed; both actions will help you spot deals and maximize your conversion. Taking advantage of some online resources may be valuable.

Common Mistakes to Avoid When Converting Currency

Working in a global environment means inevitably having to manage multiple currencies, so understanding the nuances of currency conversion is more important than ever. From miscalculating fees to overlooking exchange rates, there are a lot of common mistakes that can get in the way of a successful transaction.

Assuming that all exchange rates are equal

Converting currency can be overwhelming, but there are some common mistakes to avoid in order to get the best deal possible. Assuming that all exchange rates are equal is probably the most important blunder to avoid.

Some banks, foreign exchange kiosks and credit cards offer different rates and when converting large amounts of money, even small fluctuations in the rate can mean a big difference in what you receive. Make sure to shop around for the best overall rate, including assessing any fees that may vary between providers.

Not checking for hidden fees

Unforeseen charges like conversion rate fees and international transfer fees can lead to a higher cost than expected when transferring money between currencies. It’s important to understand all of the different rates and fees associated with in-person transfers, online money transfers, or other banking methods that provide different currency conversion options.

Not exercising caution around these costs can quickly add up, squeezing a budget. Do your research to ensure you are getting the best exchange rate before transferring funds overseas.

Not being mindful of the conversion rate when using credit cards

When making a purchase in a foreign country, converting currency is an important step that needs to be done correctly. Not taking the conversion rate into account when using credit cards to purchase goods and services can cause you to incur additional fees and charge more than you intended.

If you make cash withdrawals from ATMs abroad, compare the exchange rate offered by your bank versus the current market rate because sometimes banks charge a premium on these transactions. Failing to check for applicable taxes or fees on international transactions can cause significant financial losses.

Ignoring the impact of fluctuating exchange rates on your budget

Ignoring the impact of fluctuating exchange rates on your budget can result in significant financial losses. It is important to research and understand how currency conversion fees may apply, as they can vary significantly between banks and credit cards.

Converting currencies too slowly with an unfavorable exchange rate can also hurt your wallet; the most competitive rates are usually found online with digital currency transfers. It is essential to keep accurate records so that you won’t be charged income taxes twice on international transactions.

In Conclusion

Understanding the basics of currency exchange can make a significant difference when traveling, and this is especially true for those visiting the Philippines. Knowing efficient methods for exchanging currency can save travelers time and energy while ensuring they get the best possible rate.

By following these strategies, including studying exchange rates ahead of time, using peer-to-peer mobile applications, and asking locals for advice, travelers to the Philippines can confidently navigate their way through currency conversion and maximize their travel budget – meaning more money to enjoy the trip with.