Are you planning to travel to the Philippines and looking for tips on how to make your money go further? Knowing the basics of currency conversion in the Philippines is essential if you want to get the most out of your trip. With a combination of different currencies floating around, it can be tricky to figure out which ones you should use when making purchases.

In this blog, we’ll provide some tips and tricks to help make your trip to the Philippines successful and affordable. From understanding exchange rates to knowing which type of cash is best for any given situation – we’ll cover it all! Read on to learn more about how you can maximize your money while visiting the Philippines.

Understanding the Philippine Peso and Its Exchange Rate

Understanding the Philippine Peso and its exchange rate is an important part of navigating currency conversion in the Philippines. The Philippine Peso, also known as PHP, is the official currency of the Philippines. It is divided into 100 centavos, and is denoted by the symbol “₱”. The exchange rate of the Philippine Peso is the value at which one currency, such as the US dollar, can be exchanged for the Philippine Peso.

This rate is constantly changing due to a variety of factors such as inflation, supply and demand, and government policies. It’s important to keep an eye on the exchange rate if you plan on traveling to the Philippines or conducting business with the country, as it can greatly affect the cost of goods and services.

The Philippine Peso, or PHP, is the official currency of the nation, and its value fluctuates from day to day in other currencies. Factors such as political stability, inflation rates, trade agreements, and interest rates can all affect its value. Knowing how to keep track of these fluctuations can help you stay aware of economic developments and make informed financial decisions.

Identifying the best places to exchange currency can also be key for getting a better deal on your transactions. Exchange bureaus are often more convenient than banks for exchanging PHP into foreign currencies. Looking up reviews online or asking locals for recommendations can help you find trusted places with competitive rates. It’s also important to read all terms and fees before agreeing to an exchange or making a purchase.

Identifying the Best Places to Exchange Currency

When traveling abroad, knowing where you can exchange currency at the best rate is important. There are several options available, each with different advantages and disadvantages. Here are a few of the most common:

Banks

The most traditional option for exchanging currency is banks. Banks offer competitive exchange rates but require more paperwork and may be limited in depending on opening hours.

Airport Kiosks

Kiosks in airports typically offer fair exchange rates but also have high fees attached, so it’s not usually the best choice for exchanging large amounts of cash. It is convenient if you’re flying out shortly after arriving in a new country though!

Money Changers/Bureau de Change

Some countries have money changers or bureau de change who offer great exchange rates that beat almost any other option. It is often wise to shop around as some bureau de change may charge commission or other fees, so you want to ensure you get the best rate possible.

Online Options

More and more online services offer currency exchange, such as TransferWise or Revolut. These apps allow users to quickly transfer money between different currencies with low fees and good exchange rates. They are convenient when traveling and can save a considerable amount of money on international transfers compared to the traditional banking system.

Tips for Getting the Best Exchange Rate

Exchanging currency when traveling abroad can be a confusing process, and it is important to be careful to get the best possible rate. Here are a few tips to follow:

Shop Around

Before exchanging money, do your research by looking at different banks, bureau de change, and online services available. Make sure to compare the exchange rates and fees attached to ensure you’re getting the most bang for your buck!

Use Online Services

Online services often offer better exchange rates than banks or other physical locations. Services such as TransferWise or Revolut provide hassle-free transfers with low fees and great exchange rates.

Avoid Airport Kiosks

Kiosks in airports typically offer terrible exchange rates with high fees attached. So unless you’re traveling out of town soon after arriving in a new country, it’s wise to avoid exchanging money at airport kiosks altogether.

Understanding Currency Conversion fees

Understanding currency conversion fees can seem complicated, but with a little bit of research, it doesn’t have to be overwhelming. It is important to know the exchange rate at the time of your transaction as well as any additional fees or charges that may apply. Different lenders, banks, and money transfer services will include different types of fees based on their policies.

Some common types of currency conversion charges include flat fees for transfers, transfer size, margin rates that add an extra percentage each time funds are converted from one currency to another, and taxes, among others. It is essential to check with potential providers before getting started and make sure you understand how those costs will affect your finances in the long run.

With careful planning and understanding of the various associated costs and fees, you can be better prepared to make wise decisions when it comes to transferring money across borders. It is important to do your research before exchanging any currencies. Depending on the source, you may have to pay transaction fees, exchange rate fees, withdrawal fees, and more. Different providers will offer 4 different types of exchange rates: a spot rate, forward rate, bid rate, or an asking rate.

Making sure you’re aware of these costs goes a long way in ensuring that you don’t end up overpaying for any currency exchanges, so it pays to do your homework.

Using Credit Cards and ATMs for Currency Conversion

When traveling outside your home country’s borders, using credit cards and ATMs to convert currency can be quite convenient. Not only are both methods fast and easy, but they can often provide the best exchange rate when compared to other conversion services.

For example, when utilizing a Visa or Mastercard credit card while abroad, banks will usually dispense transactions in their local currency but ultimately charge you in your native currency at the current exchange rate. This can be especially beneficial if the foreign country has more favorable exchange rates than your own.

Additionally, withdrawing money from an ATM is much easier than manually exchanging cash – it eliminates the long lines and potential for human error that can result from manual conversion. If you plan to take advantage of these services while traveling abroad, make sure to research what fees are associated with each method before you begin, and always be wary of potential scam ATMs!

Staying Safe and Avoiding Scams When Converting Currency

Staying safe when converting currency is an important part of ensuring that a traveler’s finances are well-protected. Since many countries have local regulations and taxes associated with currency conversion, it is important to work with reliable and secure providers. Before making any exchanges, it is also wise for travelers to research the conversion rates offered by different service providers so they can get the best returns on their money.

Additionally, travelers should be aware of potential scammers who look to take advantage of those conducting currency conversions by promising them unrealistic exchange rates or high returns. Be sure not to transact with any third-party services that do not have a legitimate website or require payment information before providing access to conversion services as these could be signs of fraudulent activity.

Common Mistakes to Avoid When Converting Currency

When it comes to converting currency, many people make mistakes that can cost them money. Whether you’re exchanging your money for a vacation or simply trying to manage an international transfer, there are some common pitfalls and mistakes you should be aware of when dealing with foreign currency exchange (FX). Below are some of the most common errors people make when converting currency, and how to avoid them

| Common Mistakes | How to Avoid |

|---|---|

| Not Shopping Around | Before exchanging money, compare the exchange rates of different banks, bureau de change and online services. Ensure you get the best rate possible by doing research beforehand. |

| Using Airport Kiosks | Airport kiosks typically offer terrible exchange rates with high fees attached, so it’s wise to avoid these altogether when converting currency. |

| Not Checking Bank Commission Fees | Banks often charge commissions or other fees for exchanging currency. Be sure to check these fees before completing your transaction in order to get the most bang for your buck. |

| Not Considering Local Currency Options | In some countries, there may be more than one type of local currency. Consider which is the better option before transferring funds. |

| Ignoring Fees and Taxes | Certain currencies have additional taxes and fees associated with them, such as remittance charges or stamp duties. Make sure to factor these in when calculating your exchange rate. |

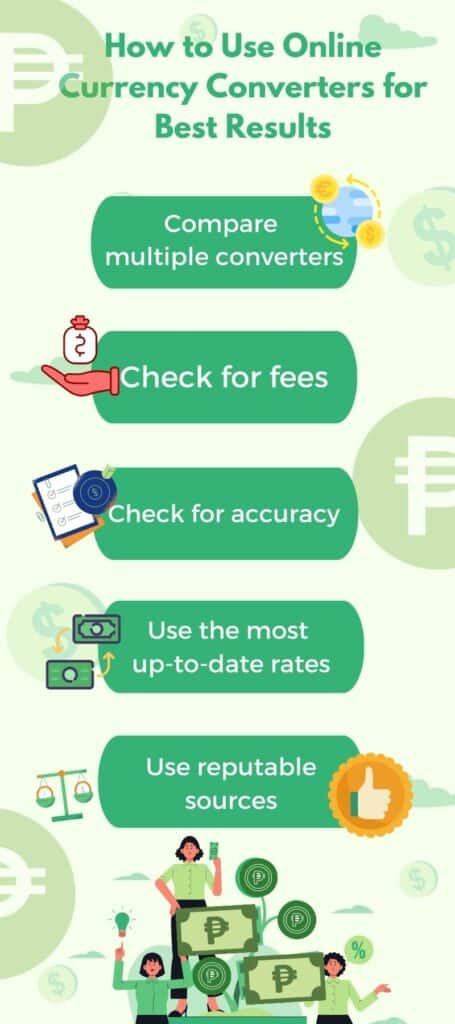

How to Use Online Currency Converters for Best Results

Using online currency converters can be an easy and convenient way to get up-to-date exchange rates and convert currency. Here are some tips for using online currency converters for the best results:

Compare multiple converters: Don’t rely on just one currency converter. Compare rates from multiple sources to ensure that you are getting the best exchange rate.

Check for fees: Some online currency converters charge a fee for their service, so be sure to check for this before using one.

Check for accuracy: Make sure that the exchange rate you are getting is accurate by cross-checking it with the rates from other sources.

Use the most up-to-date rates: Currency rates are constantly changing, so make sure you are using the most recent rates available.

Use reputable sources: Use well-known and reputable currency converter websites to ensure that the information provided is accurate.

Keep in mind that the conversion rate on the card network or bank may be different from the online currency converter, so it’s always good to check the rate from your bank or credit card company.

By following these tips, you can ensure that you are getting the most accurate and up-to-date exchange rates when using online currency converters.

How to Manage Currency Conversion When Traveling to the Philippines

Managing currency conversion when traveling to the Philippines can be a bit of a challenge, but with a few simple tips, you can ensure that you have a smooth and stress-free experience. Here are some tips for managing currency conversion when traveling to the Philippines:

Research the exchange rate: Before you travel, research the current exchange rate for the Philippine Peso. This will help you budget for your trip and know how much money you should bring.

Bring cash: It’s a good idea to bring some cash in the local currency, as not all places in the Philippines accept credit cards.

Use ATMs: ATMs are widely available in the Philippines, and they are a convenient way to withdraw local currency. Just make sure to check with your bank about any fees that may be associated with using foreign ATMs.

Use credit cards: Credit cards are widely accepted in the Philippines, but check with your bank about any foreign transaction fees that may apply.

Be mindful of the fees: Be aware of any fees that may be associated with currency conversions, such as exchange rate fees, ATM withdrawal fees, or credit card foreign transaction fees.

Be familiar with the local currency: It’s helpful to familiarize yourself with the local currency and its denominations, so you can make accurate transactions and avoid being taken advantage of.

By following these tips, you can ensure that you have a smooth and stress-free experience when managing currency conversion when traveling to the Philippines.

In conclusion

Currency conversion can be a daunting and confusing process, but with a little bit of research and preparation, travelers can ensure that they get the best exchange rates when converting currencies. Researching the current exchange rate for the Philippine Peso before you travel, bringing cash in local currency, using ATMs or credit cards when possible.

By being mindful of the fees associated with currency conversion, and familiarizing yourself with the local currency and its denominations, you can ensure that your experience is smooth and stress-free. With a little bit of effort beforehand, you can rest assured that you will get the most out of your money when traveling to the Philippines.