Effective currency conversion is an important part of international travel, and the Philippines is no exception. In order to get the most out of your visit to the Philippines, it’s critical to be aware and educated on the various guidelines surrounding currency exchange in this vibrant country.

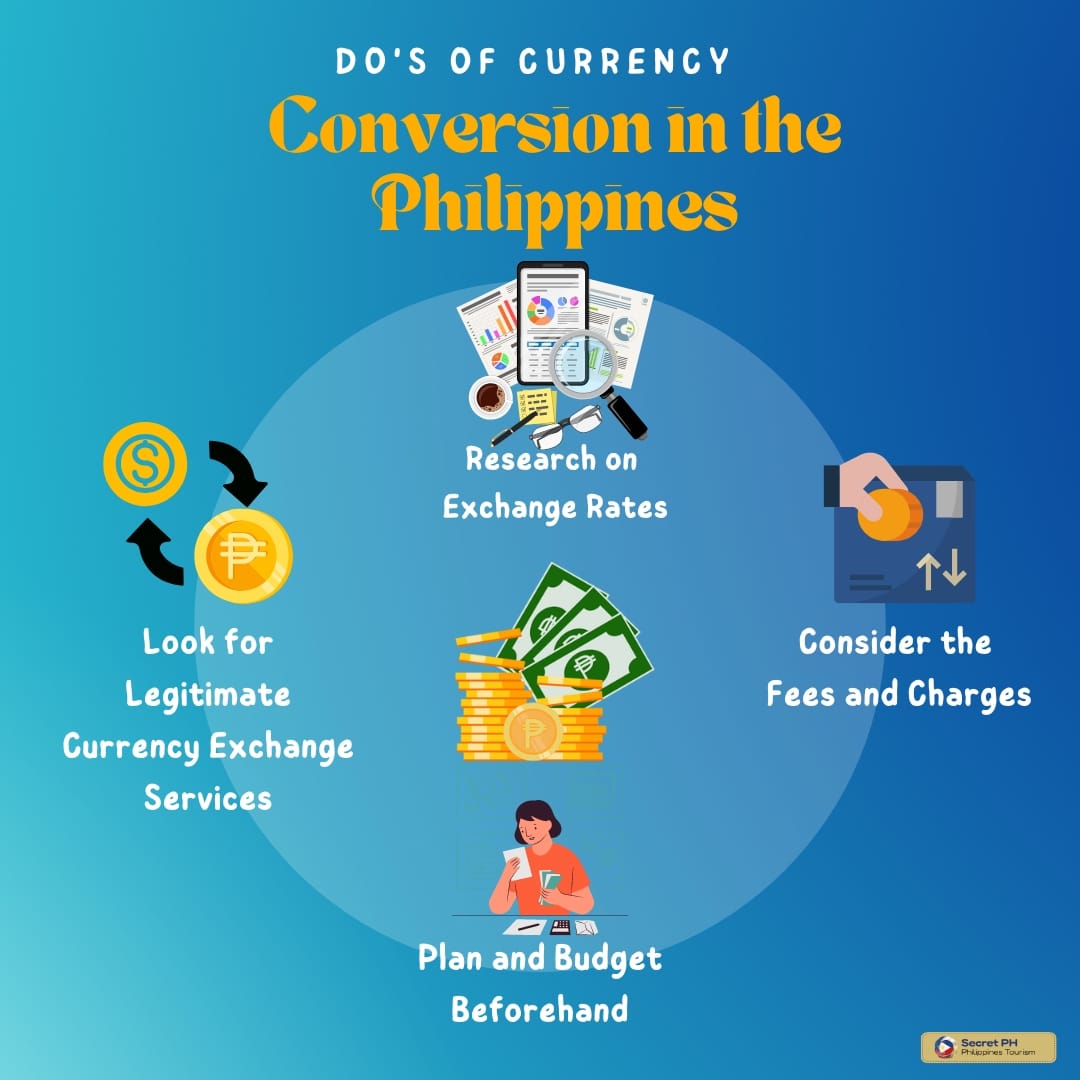

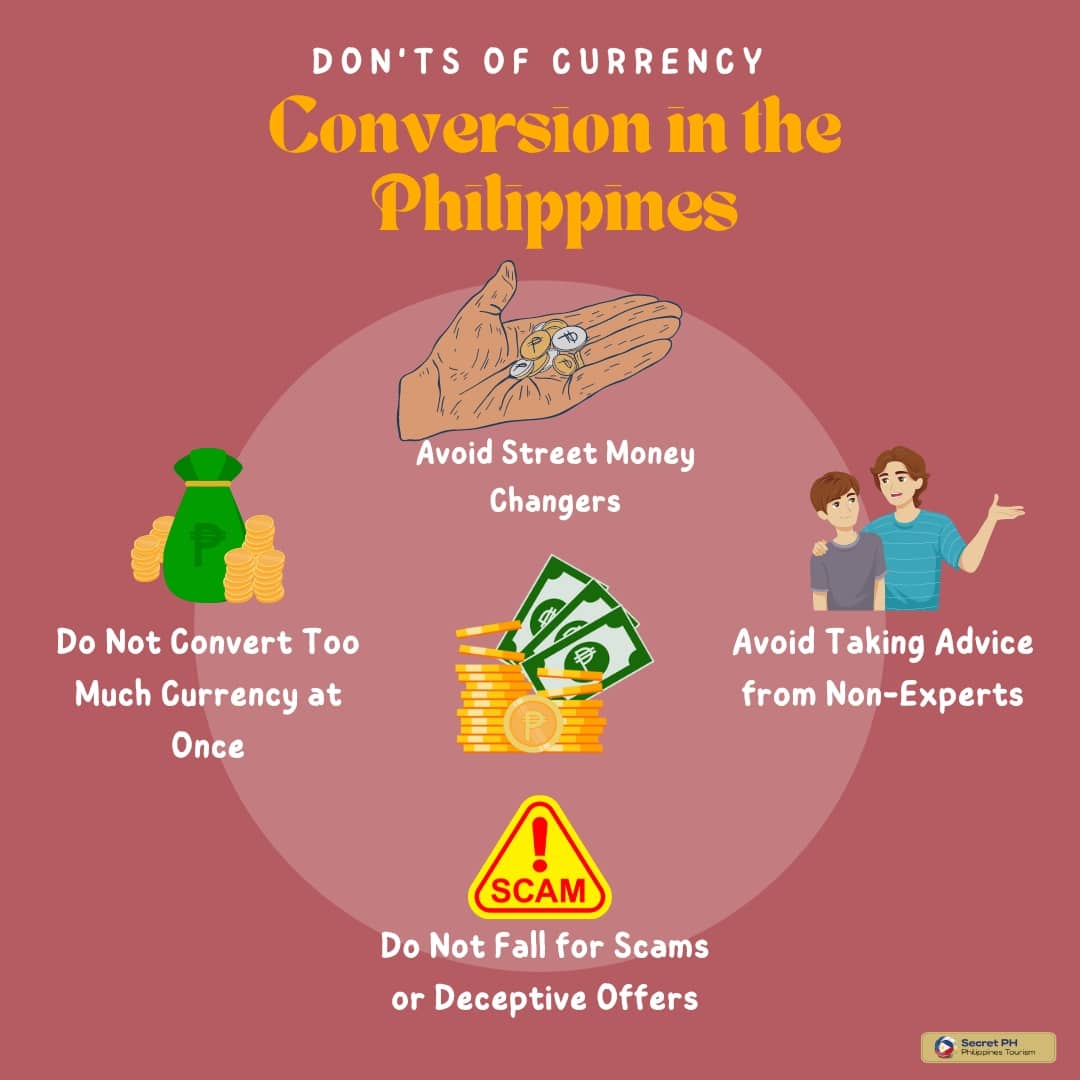

When converting your currency, it is important to research exchange rates, look for legitimate currency exchange services, consider fees and charges, and plan and budget beforehand. On the other hand, it is crucial to avoid street money changers, converting too much currency at once, taking advice from non-experts, and falling for scams or deceptive offers.

This guide will provide an overview of everything you need to know about currency conversion in the Philippines. Armed with this knowledge, you’ll be prepared and confident as you embark on your journey.

Do’s of Currency Conversion in the Philippines

Currency conversion can be a confusing and overwhelming task, especially if you are unfamiliar with the process. However, with the right information and preparation, you can make the most of your money and enjoy a hassle-free experience while traveling to the Philippines.

In this section, we will be discussing the dos of currency conversion in the Philippines, covering topics such as research on exchange rates, finding legitimate currency exchange services, and planning your budget beforehand. By following these guidelines, you can ensure that your currency conversion experience is a positive and stress-free one.

Research on Exchange Rates

Researching exchange rates is an important step when it comes to currency conversion in the Philippines. Knowing the current exchange rate between your home currency and the Philippine peso can help you make informed decisions when it comes to converting your money. This can also help you avoid paying too much or receiving too little in the exchange process.

There are several ways to stay updated on the latest exchange rates, such as checking online resources, subscribing to alerts or newsletters, or consulting a currency specialist. You can also compare the exchange rates offered by different currency exchange services to find the best deal.

It is important to note that exchange rates are subject to fluctuations and can change quickly, so it is recommended to keep an eye on them and update yourself regularly. By staying informed on the latest exchange rates, you can maximize the value of your money and minimize the risks involved in currency conversion.

Look for Legitimate Currency Exchange Services

When converting your currency in the Philippines, it is crucial to look for legitimate currency exchange services. This will ensure that you receive the correct amount of money and that your transactions are secure and protected.

Legitimate currency exchange services are typically located in banks, authorized money changers, or reputable foreign exchange bureaus. They are regulated by the government and comply with anti-money laundering and other financial regulations. These services are often more trustworthy and offer better exchange rates than street money changers or unauthorized providers.

Before exchanging your currency, make sure to check the credentials and reputation of the currency exchange service. Ask for referrals from other travelers or do some research online to find out if the service has a good reputation. You can also check if the service is registered with the Central Bank of the Philippines or any other relevant regulatory body.

By choosing a legitimate currency exchange service, you can be confident that your money is in safe hands and that you are receiving the correct amount of pesos for your currency.

Consider the Fees and Charges

When converting your currency to the Philippines, it is important to consider the fees and charges associated with the exchange. These fees can add up quickly and can significantly reduce the value of your money if not taken into account.

There are several types of fees and charges that you may encounter when exchanging your currency, such as commission fees, service charges, or exchange rate mark-ups. Some currency exchange services may also charge additional fees for services such as cash delivery or foreign currency conversion.

Before exchanging your currency, it is advisable to ask the currency exchange service about their fees and charges. You can also compare the fees and charges of different currency exchange services to find the best deal.

Some services may offer more competitive exchange rates but charge higher fees, while others may have lower fees but offer less favorable exchange rates.

By considering the fees and charges associated with currency conversion, you can make informed decisions and avoid paying more than necessary. This can help you get the most value for your money and make your travels to the Philippines more enjoyable.

Plan and Budget Beforehand

Planning and budgeting beforehand is an essential step when it comes to currency conversion in the Philippines. By preparing in advance, you can avoid unnecessary expenses and ensure that you have enough funds to cover your expenses during your travels.

When planning your budget, take into account the cost of your accommodation, transportation, food, and other expenses. This will help you determine the amount of money you need to convert and the best way to convert your currency.

You can also consider the exchange rates and fees associated with different currency exchange services, as well as the various options for exchanging your currency, such as cash, credit cards, or traveler’s checks.

By planning and budgeting beforehand, you can ensure that you have a stress-free and enjoyable experience while traveling to the Philippines. You can also avoid running out of money or overspending, which can cause financial difficulties and ruin your trip.

Don’ts of Currency Conversion in the Philippines

Currency conversion in the Philippines can be a confusing and stressful process if you are not prepared or do not know what to avoid. By following the right guidelines and avoiding common pitfalls, you can ensure that your currency conversion experience is smooth and safe.

In this section, we will be discussing the don’ts of currency conversion in the Philippines, covering topics such as avoiding street money changers, not converting too much currency at once, and avoiding scams or deceptive offers. By following these guidelines, you can make the most of your money and enjoy a hassle-free experience while traveling to the Philippines.

Avoid Street Money Changers

When converting your currency in the Philippines, it is important to avoid street money changers. Street money changers, or unauthorized currency exchange providers, are not regulated by the government and may not follow anti-money laundering or other financial regulations.

These street money changers often offer more favorable exchange rates compared to legitimate currency exchange services, but they also pose a higher risk to your money and personal security. Street money changers may not provide receipts for your transactions or may engage in fraudulent activities, such as shortchanging customers or exchanging counterfeit currency.

If you need to exchange your currency, it is advisable to use legitimate currency exchange services, such as banks, authorized money changers, or reputable foreign exchange bureaus. These services are regulated by the government and offer more secure and trustworthy transactions.

By avoiding street money changers, you can protect your money and personal security, and ensure that you receive the correct amount of pesos for your currency. This can help you have a stress-free and enjoyable experience while traveling to the Philippines.

Do Not Convert Too Much Currency at Once

It is important to avoid converting too much currency at once. Converting large amounts of currency at once can increase your exposure to currency fluctuations and may result in a significant loss of value.

It is advisable to convert only the amount of currency that you need for your immediate expenses and to keep the rest in a more secure and easily accessible form, such as a credit card or traveler’s check.

By not converting too much currency at once, you can minimize your exposure to currency fluctuations and ensure that you have access to your money when you need it. This can help you stay within your budget and avoid financial difficulties while traveling to the Philippines.

Avoid Taking Advice from Non-Experts

It is important to avoid taking advice from non-experts. The exchange rate and currency conversion process can be complex and is subject to change, and seeking advice from non-experts may result in incorrect information or poor decisions.

Instead, it is advisable to seek information from reliable and knowledgeable sources, such as banks, authorized money changers, or professional financial advisors. These experts have access to up-to-date information on exchange rates and can provide accurate and helpful advice on the best way to convert your currency.

Additionally, it is important to be cautious of individuals or companies offering seemingly attractive exchange rates or financial products. Some of these offers may be scams or may come with hidden fees and charges that can negatively impact your financial situation.

By avoiding taking advice from non-experts and seeking information from reliable sources, you can make informed decisions and protect your money when converting your currency to the Philippines.

Do Not Fall for Scams or Deceptive Offers

Be vigilant and avoid falling for scams or deceptive offers. The currency exchange market is ripe for scams and deceptive practices, and falling for these offers can result in significant financial losses or security risks.

Some common scams include individuals or companies offering unusually favorable exchange rates or financial products, such as investment schemes or high-yield savings accounts. These offers may be fraudulent or may come with hidden fees and charges that can negatively impact your financial situation.

It is important to be cautious and to research any offer before accepting it. Seek information from reliable and knowledgeable sources, such as banks, authorized money changers, or professional financial advisors.

Additionally, it is advisable to protect your personal information, such as your passport or credit card information, and to only provide it to trusted and secure sources.

By being vigilant and avoiding scams or deceptive offers, you can protect your money and personal information when converting your currency to the Philippines.

In conclusion

Overall, following the 8 Do’s and Don’t of currency conversion in the Philippines can ensure a smoother, simpler, and stress-free transaction process.

Keeping in mind suggestions like doing research on exchange rates, using reliable physical or online services, not leaving last-minute transactions too late, and having an alternate plan if something doesn’t go as planned are key elements that should be implemented when planning a currency conversion.